Corporate Governance

- Font size

-

- Standard

- Increase

Basic views on Corporate Governance

The Company views Corporate Governance as a base for all business in the Keikyu Group and as a concept that forms the basis of management.

As a corporate entity responsible for a service that is a lifeline for many, the Company group (the “Group”) works to ensure the highest level of safety in all aspects of its business, while seeking appropriate cooperation with stakeholders such as customers, shareholders, investors, local communities, suppliers, employees, and society as a whole, as well as working in harmony with the environment. These measures are aimed at achieving sustainable growth and at raising corporate value over the medium- to long-term, in pursuit of which goals the Group implements initiatives to strengthen corporate governance on a continuous basis, aiming for establishing a highly transparent and objective corporate governance system, based on the Group Philosophy (business principles and code of conduct) Basic Policies on Sustainability and the Long-Term Vision.

For details regarding compliance with the Corporate Governance Code, please refer to “Corporate Governance Reports” below.

Evaluation of the Effectiveness of the Board of Directors

Evaluation Summary

To enhance the effectiveness of the Board of Directors each Director and Audit & Supervisory Board Member participate in an annual evaluation of the Board. The results of the evaluation are utilized in deliberations on issues and in the administration of the Board. Further, to elicit frank opinions from those surveyed, since fiscal 2018 an external organization has been commissioned to collect and tabulate the survey results. In addition, the analysis and evaluation of the effectiveness of the Board as a whole is disclosed in the Corporate Governance Report and the Annual Securities report.

Target Group

Director, Audit & Supervisory Board Member

Evaluation Method

Third-party organization survey

Main Evaluation Items

- The State of the Board

- Composition of the Board

- Administration of the Board

- Deliberations at Board meetings

- Monitoring function of the Board

- Training

- Initiatives of the Board

Results of FY2023 effectiveness evaluation and initiatives, etc.

In FY2023, the Company conducted initiatives throughout the year as a response to the following issues recognized through the FY2022 effectiveness evaluation.

- Narrow down of the number of examination items (ensuring adequate time for review)

- Enhance discussions on human resources strategies and intellectual property strategies.

- Enhance discussions on promotion of DX (digital transformation).

- Set KPIs appropriately and enhance various forms of information disclosure.

Looking at the results, some improvement has been observed with regard to “Narrow down of the number of examination items (ensuring adequate time for review)” as a result of the Company having addressed the objective continuously over three years beginning in 2020 when the objective was recognized as an issue, through initiatives that have included revising the Meeting Agenda Criteria with the aim of delegating matters to the Group Management Committee and setting annual agendas. In addition, the evaluation and judgment have determined that improvement has been observed and that effectiveness has been assured with regard to appropriate discussion for “Set KPIs appropriately and enhance various forms of information disclosure” as a result of the Company having discussed important sustainability issues and other such matters multiple times. On the other hand, concerning “Enhance discussions on human resources strategies and intellectual property strategies” and “Enhance discussions on promotion of DX (digital transformation),” while recognition was given to the various measures taken throughout the year, some parts of these issues were not resolved, and in order to further improve on these issues, they will continue to be issues in FY2024. The Company will continue to work on these issues to improve the effectiveness of the Board of Directors.

Tasks Going Forward

In addition to the issues already mentioned above, the following issues have been newly recognized from the FY2023 effectiveness evaluation.

- Enhance discussions on management based on the cost of capital and the share price, and monitoring thereof.

- Enhance discussions on human rights concerns in the workplace and the supply chain.

- Formulate and appropriately supervise objectives and action plans regarding appointment of female officers.

In FY2024, we will strive to maintain and improve the effectiveness of the Board of Directors by continually carrying out initiatives to respond to the aforementioned issues.

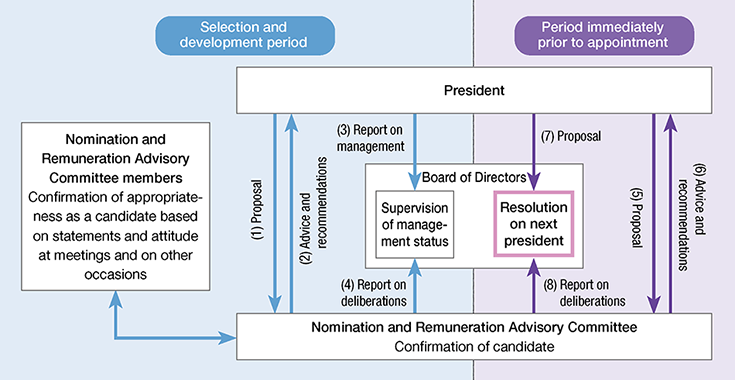

President Succession Plan

Successor Development Policy and Selection Process

With the aim of ensuring that the Group sustains growth and enhances corporate value over the medium to long term, successors to the position of president are developed and appointed in a planned manner. To further systematize this planning, a president succession plan is formulated. In formulating the plan, a series of deliberations are conducted by the Nomination and Remuneration Advisory Committee, which is chaired by an independent outside director and in which independent outside directors constitute a majority. In FY2023, we reviewed our training program for the President and Representative Director and the selection of candidates for the Board of Directors and Executive Officers. Going forward, management of the succession plan will continue based on the Nomination and Remuneration Advisory Committee’s monitoring of the progress in successor development and based on supervision conducted by the Board of Directors.

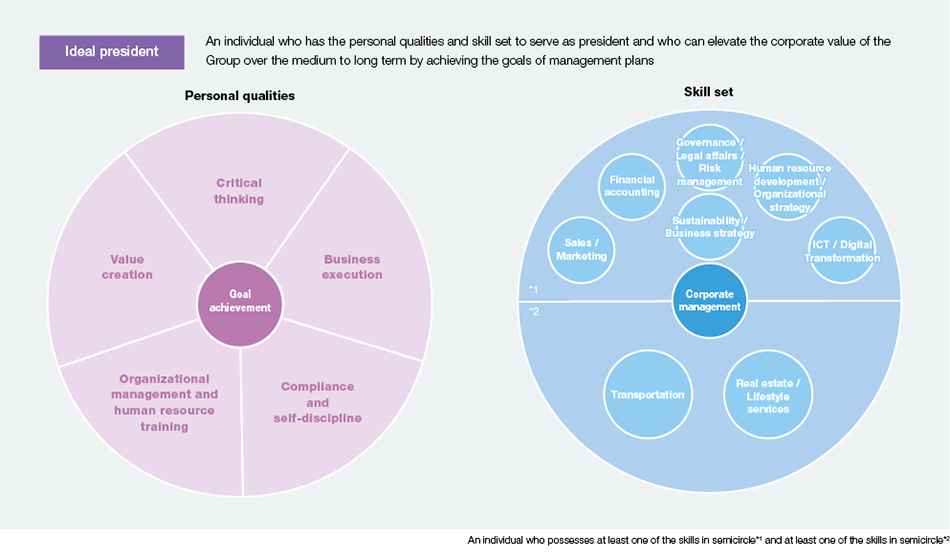

Qualities Required of the President

To ensure that the appointment of the president is properly conducted through a transparent and fair process, the Group defines the ideal president and, under the categories of personal qualities and skill set, clarifies the attributes sought. In accordance with changes in the business environment, we will continue revising the personal qualities and skill set we seek in our president.

Officer Training

The Company conducts training that enhances the skills that officers need to perform their roles and duties. Through officer training that takes into account the business environment and external affairs, the Company strengthens the business management capabilities of directors and executive officers. In fiscal 2021, officer training focused on the Task Force on Climate-related Financial Disclosures. In addition, Audit & Supervisory Board members acquire the knowledge required to fulfill the responsibilities of their positions by actively participating in external training events and studying diligently. Additionally, when outside directors and outside Audit & Supervisory Board members assume office, measures are taken to deepen their understanding of the Group, including the provision of summary information on the Group—which covers its businesses, finances, and organization—and tours of Group facilities as necessary.

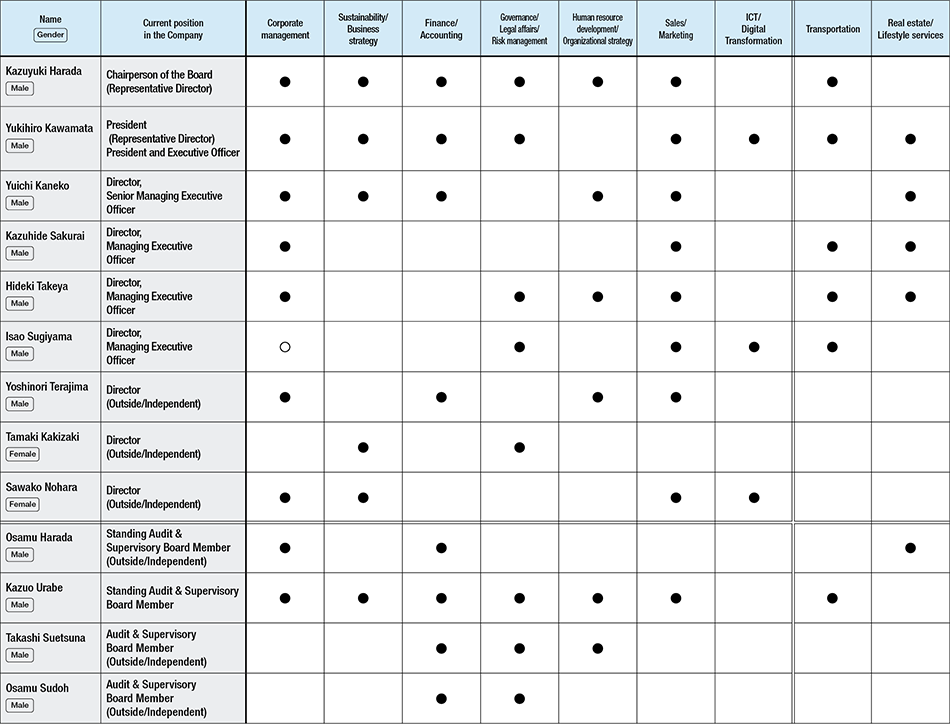

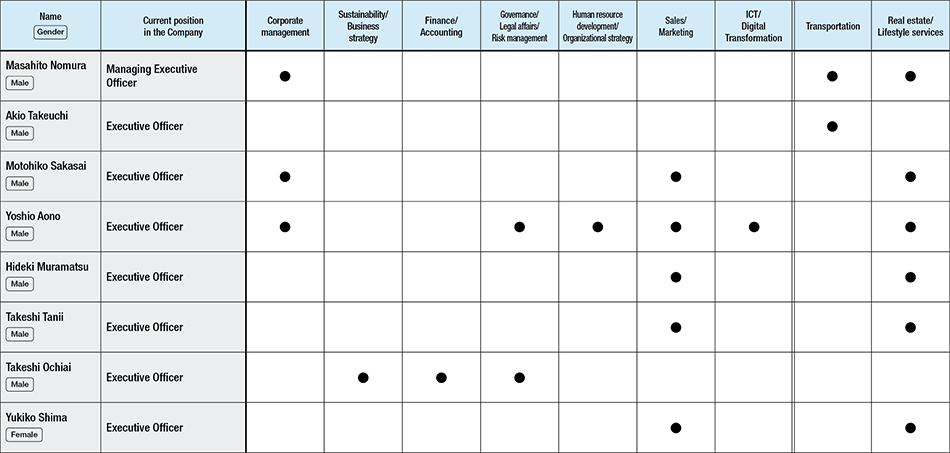

Skills Matrix (As of April 1, 2025)

In light of its medium- to long-term management strategy and management issues, the Company has set out the skills (knowledge, experience, and capabilities) required for the effective functioning of Directors and Audit & Supervisory Board Members. Inside directors are required to have skills related to business and administrative divisions and a deep understanding of the Company’s business. In addition, outside directors are expected to have expertise, extensive experience, and a broad range of knowledge that can be utilized in the supervision of business execution. Audit & Supervisory Board Members are required to have expertise, extensive experience and a broad knowledge for conducting audits of management. The skills of Directors and Audit & Supervisory Board Members are as follows.

The Company has introduced an executive officer system. The following table shows the skills of executive officers who do not cocurrently serve as directors.

- 1.A “○” check mark signifies skills to be developed going forward as the officer in charge.

- 2.The above matrix does not represent all the skills possessed by Directors, Audit & Supervisory Board Members, and executive officers who do not concurrently serve as directors.

Notes:

Reasons for selection of the skills that comprise the Skills Matrix are as follows.

| Skills | Reasons for selection |

|---|---|

| Corporate management | To appropriately fulfill management supervisory roles and to promote the enhancement of management capital, which forms the basis for corporate value creation. |

| Sustainability/ Business strategy |

To formulate strategies that contribute to the sustained growth of the Group and the enhancement of social and corporate value over the medium to long term, thereby promoting management and business activities. |

| Finance/Accounting | To ensure the appropriateness and accuracy of financial reporting. Additionally, to ensure financial soundness for promoting large-scale growth investments, and to develop management practices focused on the profitability of capital and stock price. |

| Governance/Legal affairs/ Risk management |

To build a corporate structure that is resilient to risk by possessing a knowledge of governance as the foundations of business management while accurately identifying management risks and taking appropriate countermeasures. |

| Human resource development/ Organizational strategy |

To promote human capital management through the development of human resources who can create and co-create value from a customer perspective, and through the creation of an innovation-encouraging culture. |

| Sales/Marketing | To improve the corporate brand and the brand image of communities along the Keikyu lines by delivering services that cater to the diverse needs of customers. |

| ICT/Digital Transformation | To achieve next-generation operations in transportation by combining digital and real elements and to drive strategic marketing initiatives by leveraging data. |

| Transportation | To ensure core businesses provide and sustain services that both meet public needs and realize profitability and to optimize all modes of transportation to enhance the value of communities and expand the scale of lineside areas. |

| Real estate/ Lifestyle services |

To strengthen and promote the real estate operations, developing them into the Group’s second most profitable business, and to create opportunities for people to move around and increase the flow of people by establishing hubs and providing living support. |

In Relation to Outside Officers

[Reasons for nominating for Outside Director]

The reasons for appointing each outside officer are as follows. The number in <> indicate the number of Board of Directors meetings attended in fiscal 2023.

Outside Director Mr. Yoshinori Terajima <13/13 (100%)>

Mr. Terajima has once been involved in the management of a major life insurance company and obtained abundant experience and broad insight related to fund management and investment management, etc., and hence, the Company expects him to play a role in leveraging his experience and insight in his duties in supervising business execution, etc. of the Company. He has been serving as Outside Director of the Company since June 2018. The Company considers that he has properly performed his duties in supervising business execution, etc. of the Company and hence, appointed him as an Outside Director.

Outside Director Ms. Tamaki Kakizaki <13/13 (100%)>

Ms. Tamaki Kakizaki is a university professor specilized in the field of internal controls and internal audit, and an outside officer of an airport terminal building operation company, etc. She was an outside officer of a major pharmaceutical company, and obtained abundant experience and broad insight in these areas. The Company considers that she has properly performed her duties as Outside Director of the Company since June 2020 and hense, appointed her as an Outside Director.

Outside Director Ms. Sawako Nohara <13/13 (100%)>

Ms. Nohara has abundant experience and broad insight as manager of a company related to business and marketing strategies in the IT business, as an outside officer of a major pharmaceutical company, etc. and as an expert member of government committees, and hence, the Company expects her to play a role in leveraging her experience and insight in her duties in supervising business execution, etc. of the Company. The Company considers that she has properly performed her duties as Outside Director of the Company since June 2021 and hence, appointed her again as an Outside Director.

Outside Standing Audit & Supervisory Board Member Mr. Osamu Harada <13/13 (100%)>

Mr. Harada has once served as Standing Audit & Supervisory Board Member of a major financial institution, and as the president of a monetary claim management and collection company, obtaining abundant experience and broad insight in these areas. He serves as Outside Audit & Supervisory Board Member of the Company since June 2022.

The Company considers that he has properly performed his duties in auditing business management and hence, appointed him as an Audit & Supervisory Board Member.

Outside Audit & Supervisory Board Member Mr. Takashi Suetsuna <12/13 (92%)>

Mr. Takashi Suetsuna has once served as Chief of Kanagawa Prefectural Police Headquarters and Deputy Superintendent General of the Tokyo Metropolitan Police Department, and as a former outside officer of a major general trading company, etc. has abundant experience and broad insights. He has been serving as Outside Audit & Supervisory Board Member of the Company since June 2016. The Company considers that he has properly performed his duties in auditing business management of the Company and hence, appointed him as an Outside Audit & Supervisory Board Member.

Outside Audit & Supervisory Board Member Mr. Osamu Sudoh <13/13 (100%)>

Mr. Sudoh has high expertise in corporate legal affairs as an attorney at law. He has served as a former outside officer of a major total entertainment company. He therefore has obtained abundant experiences and broad insight into these areas. He serves as Outside Audit & Supervisory Board Member of the Company since June 2016. The Company considers that he has properly performed his duties in auditing business management and hence, appointed him as an Audit & Supervisory Board Member.

[Independence of Outside Officers]

The Company designates Outside Officers as independent officers in accordance with the “Independence Criteria for Outside Officers.”

Remuneration Plan for Officers ※As of June 2024

Basic policy for determining the amount of remuneration, etc. and its calculation method

As a corporate entity that pillars the people living along its railway lines, the Group’s highest priority is ensuring safety and security, and in order to further develop the areas along the railway lines, the Group companies work in cooperation with each other to generate synergies, a characteristic feature of the Group. In addition to taking into account the above, the Company’s remuneration for officers emphasizes not only short-term operating performance, but also contributions to raising corporate value and operating performance over the medium to long term, as well as having values in common with those of shareholders. When determining remuneration, employee salaries, trends at other companies, survey data from external research organizations and other factors are taken into account.

Composition of remuneration

The remuneration for Directors and Executive Officers is approved by the Board of Directors upon consultation with the Nomination and Remuneration Advisory Committee, the majority of whose members are Independent Outside Directors.

| Type of remuneration | Officers eligible for payment | Description |

|---|---|---|

| Fixed remuneration | Directors | A fixed amount is paid based on the Director Remuneration and Executive Officer Remuneration Rules (hereinafter the “Rules”) determined by the Board of Directors. For the Chairman of the Board, the Chairman Remuneration is added to the fixed remuneration. |

| Executive Officers | An amount determined by position is paid based on the Rules. | |

| Representative director remuneration | Chairman, Representative Director | A fixed amount is paid based on the Rules. |

| Representative Directors other than Chairman | A fixed amount and performance-linked remuneration are paid based on the Rules. | |

| Bonus | Executive Officers | To raise the incentive to improve operating performance, a benchmark amount determined by position is set as a guideline as consideration for the execution of duties during the fiscal year, and an amount taking into account operating performance, etc. is paid based on the Rules. |

| Stock remuneration | Internal Directors Executive Officers | The Company’s shares and an amount of money equivalent to the market value of the Company’s shares (hereinafter the “Company’s Shares, etc.”) are provided based on the Rules. The Company grants points to each officer based on the Officer Stock Benefit Regulations established by the Board of Directors, and the Company’s Shares, etc. according to the number of granted points are provided, in principle, when the officer retires. |

(Note) In addition to the above remuneration, the Company obtains executive accident insurance to insure all of the Directors and Executive Officers, and pays a fixed amount for the insurance premiums every month.

Policy for determining the amount of individual remuneration

1. Fixed remuneration and representative director remuneration (fixed remuneration)

| Type of remuneration | Officers eligible for payment | Method for determining remuneration | Timing of payment |

|---|---|---|---|

| Fixed remuneration | Directors | Determined based on a comprehensive consideration of societal standards, management duties, etc. | Every month |

| Executive Officers | Determined based on a comprehensive consideration of societal standards, management duties, balance with employee salaries, etc. | Every month | |

| Representative director remuneration (fixed remuneration) | Chairman, Representative Director | Determined based on a comprehensive consideration of societal standards, responsibilities as Representative Director, specialized role in supervising business execution as Chairman, etc. | Every month |

| Representative Directors other than Chairman | Determined based on a comprehensive consideration of societal standards, responsibilities as Representative Director, management duties, etc. | Every month |

2. Representative director remuneration (performance-linked remuneration) and bonus

(1) Types, etc

| Type of remuneration | Officers eligible for payment | Method for determining remuneration | Timing of payment |

|---|---|---|---|

| Representative director remuneration (performance-linked remuneration) | Representative Directors other than Chairman | Determined based on a combined quantitative and qualitative evaluation and an evaluation of operating performance. | After annual general meeting of shareholders |

| Bonus | Executive Officers | Determined based on a combined quantitative and qualitative evaluation and an evaluation of operating performance. | After annual general meeting of shareholders |

(2) Evaluation items

In order to reflect both quantitative and qualitative evaluations in representative director remuneration (performance-linked remuneration) and bonuses, the remuneration and bonus amounts are each adjusted within a range of ±30% from the benchmark amounts based on the ratings obtained from the following evaluations. In addition, depending on business performance and other factors, the amounts may be reduced by more than 30%.

| Evaluation items | |

|---|---|

| Quantitative evaluation | Conversion of the level of achievement of the business plan for the performance figures of the fiscal year, into points for evaluation (Indicators used)

|

| Qualitative evaluation |

|

(3) Evaluation proportion

- (i) Representative director remuneration (performance-linked remuneration)

- The evaluation for performance-linked remuneration for Representative Directors other than Chairman is comprised of only the portion that evaluates consolidated financial results, etc.

- (ii) Bonus

- The benchmark amounts for the Executive Officer bonuses determined based on the Rules are divided as follows, and the evaluation of operating performance is conducted separately for a portion based on consolidated financial results, etc and for a portion based on execution of duties of Senior General Managers, Vice Senior General Managers, Office Managers, General Managers and officers of Group companies.

Although the evaluation for the President consists solely of the portion based on consolidated financial results, etc the weight given to the portion based on evaluation of execution of duties for Vice President and other officers is increased in stages and established in consideration of the responsibilities and division of duties.

- (iii) Evaluation percentages by position

| Evaluation category | ||

|---|---|---|

| Portion based on consolidated financial results, etc | Portion based on execution of duties | |

| President and Executive Officer | 100% | ― |

| Vice President and Executive Officer | 70% | 30% |

| Senior Managing Executive Officer | 60% | 40% |

| Managing Executive Officer | 50% | 50% |

| Executive Officer | 40% | 60% |

3. Stock remuneration

| Officers eligible for payment | Method for determining remuneration | Timing of payment |

|---|---|---|

| Internal Directors Executive Officers | The Company grants points to each officer based on the Officer Stock Benefit Regulations established by the Board of Directors, and the Company’s Shares, etc. according to the number of granted points are provided, in principle, when the officer retires. Each point granted to the Directors, etc. is converted into one common share of the Company at the time of the provision of the Company’s Shares, etc. (If a share split, allotment of shares without contribution, consolidation of shares, etc. of the Company’s shares is conducted, reasonable adjustments in accordance with the ratio of the share split, etc. will be made to the maximum number of points, and the number of points that have been granted or the conversion rate.) | Points are granted march 31 of each year held each year The Company’s Shares, etc. are provided at the time of retirement from office in principle |

Provision percentages (annual and benchmark amounts)

| Fixed remuneration | Performance-linked remuneration and bonus | Stock remuneration | |

|---|---|---|---|

| Chairman, Representative Director | 87% | - | 13% |

| President, Representative Director | 37% | 49% | 14% |

| Representative Directors other than the above (Note) | 45% | 44% | 11% |

| Internal Directors other than Representative Directors (Note) | 54% | 29% | 17% |

| Outside Directors | 100% | - | - |

| Executive Officers (not concurrently serving as Directors) (Note) | 48% | 36% | 16% |

(Note) The percentages for each position are the average percentages.

Matters related to the determination of amounts of remuneration, etc. for individual Directors and Executive Officers

Of the remuneration amounts for individual Directors and Executive Officers, the specific amounts of ① representative director remuneration (performance-linked remuneration) are determined within the range approved by a resolution at a General Meeting of Shareholders by the President, Representative Director as delegated by a resolution of the Board of Directors. In addition, the specific amounts of ② Executive Officer bonuses are determined by the President, Representative Director as delegated by a resolution of the Board of Directors. The content of that authority is the authority to determine the details of individual remuneration, etc. The Board of Directors delegates the determination of remuneration to the President, Representative Director because the Board of Directors has determined that the President, Representative Director is the most suitable for determining remuneration, etc. comprehensively, taking into consideration the business environment surrounding the Group and the business situation, etc. of the Group. To ensure that the President, Representative Director uses the delegated authority properly, the Board of Directors submits the proposal to and receives a report from the Nomination and Remuneration Advisory Committee, and the President, Representative Director who received the above-mentioned authority shall make decisions in accordance with the contents of that report.

Within the remuneration amounts for individual Directors and Executive Officers, the amounts of ③ fixed remuneration for Directors and Executive Officers, ④ representative director remuneration (fixed remuneration) and ⑤ points granted for stock remuneration of internal Directors and Executive Officers (the number of the Company’s shares, etc. provided upon retirement) are determined within the ranges approved by a resolution at a General Meeting of Shareholders based on a resolution of the Board of Directors after the Nomination and Remuneration Advisory Committee deliberates the proposal and submits a report.

FY2022 amount of remuneration for Directors, Audit & Supervisory Board Members and Executive Officers

| Category | Total amount of remuneration (Millions of yen) | Total amount of remuneration by type (Millions of yen) | ||

|---|---|---|---|---|

| Fixed remuneration for Directors and Audit & Supervisory Board Members | Representative authority remuneration | |||

| Fixed remuneration | Performance-linked remuneration | |||

| Directors (of whom Outside Directors) | ② 226 (27) |

78 (27) |

9 (None) |

4 (None) |

| Audit & Supervisory Board Members (of whom Outside Audit & Supervisory Board Members) | 69 (43) |

69 (43) |

None | None |

| Executive Officers (not serving as Directors) | 107 | None | None | None |

| Category | Total amount of remuneration by type (Millions of yen) | Number of eligible officers (Persons) | ||

|---|---|---|---|---|

| Remuneration for Executive Officers | Stock remuneration | |||

| Fixed remuneration | Bonus | |||

| Directors (of whom Outside Directors) | 50 (None) |

58 (None) |

26 (None) |

10 (3) |

| Audit & Supervisory Board Members (of whom Outside Audit & Supervisory Board Members) | None | None | None | 5 (4) |

| Executive Officers (not serving as Directors) | 57 | 35 | 13 | 6 |

Cross-Shareholdings

Policy on Cross-shareholdings

The Company’s policy is to maintain cross-shareholdings if there is a meaningful argument to be made with regard to business cooperation, the building and strengthening of collaborative relationships, and the Company’s business strategy that such cross-shareholdings contribute to sustained growth of the business and the raising of corporate value over the medium to long term. If the meaning of holding a stock diminishes, the relevant cross-shareholding will be gradually reduced.

In accordance with the aforementioned policy, the Company has set a target of reducing the amount of cross-shareholdings (including deemed cross-shareholdings) to not more than 20% of consolidated net assets by the end of FY2023, the final year of the Medium-Term Business Plan.

Note that if there is an offer to sell the Company’s shares from a company with which the Company has cross-shareholdings, the Company will not take action to hinder such sale, such as by suggesting a decrease in transactions with that company.

Status of Cross-shareholdings

| FY2023 | FY2022 | ||

|---|---|---|---|

| Number of issues | Listed | 10 | 14 |

| Not listed | 42 | 43 | |

| Total | 52 | 57 | |

| Total carrying amount (Millions of yen) |

Listed | 33,752 | 27,323 |

| Not listed | 3,711 | 3,846 | |

| Total | 37,463 | 31,169 | |

Policy on Exercising Voting Rights Regarding Cross-shareholdings

It is the Company’s policy that it shall exercise its voting rights with regard to cross-shareholdings having first considered, based on internal standards, the business situation of each company, whether there has been major misconduct, and, if necessary, having engaged in dialogue with the issuing company. The details of the proposals are then scrutinized to ascertain whether they contribute to raising the corporate value and shareholder value of the Company over the medium- to long-term, before a comprehensive judgment is formed on their compatibility with the purpose of cross-shareholding.